Ads

Why to choose the Neo Financial MasterCard

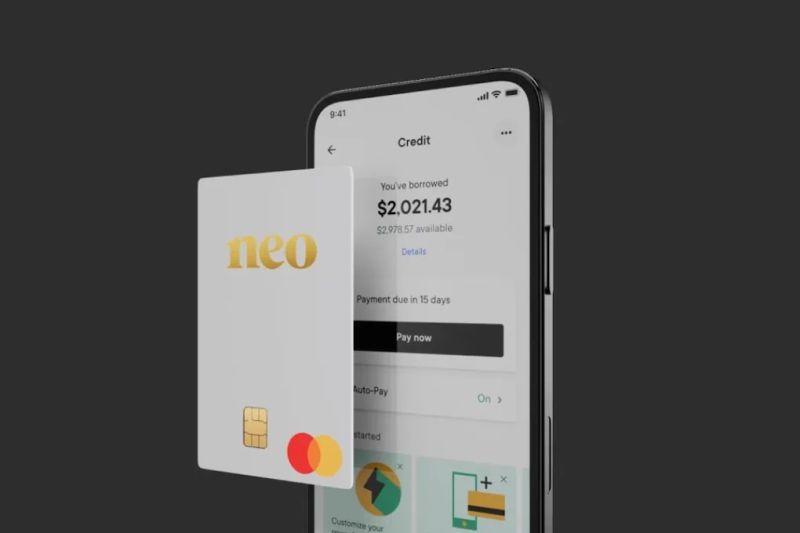

Explore the Neo Financial Mastercard – your ideal companion for shopping and spending.

Optimizing rewards becomes effortless with a high rewards card. It should feature a reasonable annual percentage rate, a substantial maximum rewards rate, and enticing sign-up bonuses. The rewards should be sufficiently high to ensure the card is a valuable choice for your transactions, offering the highest possible returns.

For high-income individuals seeking impressive rewards and perks, a high rewards credit card is the optimal choice. Notably, rewards credit cards for everyday purchases acknowledge your spending with points redeemable for cash back, airline miles, or gift cards. Don’t overlook the significance of selecting a card with comprehensive travel insurance and substantial coverage.

Individuals on a tight budget can maximize spending by utilizing a rewards credit card for everyday purchases. If you’re on the lookout for a rewards credit card, be vigilant for top-notch deals. One enticing option you may encounter is the Neo Financial MasterCard.

- ZERO LIABILITY

- EARN UP TO 15% CASHBACK

GET THE CARD BENEFITS TODAY!

☑ External URL

What is so amazing about the Neo Financial MasterCard?

Neo Financial, a financial services firm, issues a cashback rewards card to its cardholders, allowing them to earn a 5% cashback reward on all transactions conducted at Neo partnered establishments.

The card offers a cashback rewards system as one of its key benefits, providing cardholders with rebates for each transaction. Moreover, the card features low-interest rates, making it attractive to individuals seeking a credit card with favorable interest terms and inclusive eligibility criteria. Notably, the Neo Financial MasterCard stands out by having no annual or monthly fees, distinguishing it from certain other cashback reward credit cards.

Benefits of the Neo Card

The Neo Financial MasterCard stands out among rewards credit cards, providing a popular incentive for everyday spending by allowing users to accumulate points. These points can later be exchanged for various rewards, including cash back, airline miles, or other goods. Here are some key benefits of this card:

- High Cashback Rewards: The Neo Financial MasterCard offers substantial cashback rewards to its cardholders, making it an attractive choice for those looking to maximize their spending. Notably, it distinguishes itself by not charging an annual fee, setting it apart from many other cards.

- 15% Cashback Welcome Bonus: Elevating its appeal, the Neo Financial MasterCard presents a generous 15% cashback welcome bonus for your initial purchase. By signing up for the card, you can enjoy this bonus when making your first transaction with Neo partnered retailers.

- Average 5% Cashback on Neo’s Partnered Retailers: Experience an average of 5% cashback on purchases made at Neo’s partnered retailers. This feature makes the Neo Financial MasterCard an excellent choice for individuals looking to save money on their day-to-day expenses.

- No Minimum Annual Income Requirement: Unlike some credit cards, the Neo Financial MasterCard doesn’t impose a minimum annual income requirement, providing accessibility to a broader range of individuals. This feature enhances its inclusivity and appeal as a versatile financial tool.The Neo Financial MasterCard is a consumer credit card accessible to individuals with a modest income, as it does not mandate a minimum annual income requirement.

The Neo Financial MasterCard is a consumer credit card accessible to individuals with a modest income, as it does not mandate a minimum annual income requirement.